Amending the Income Tax Return Form. Computation of Tax 10 10.

Malaysia Inflation Rate 2027 Statista

The gobear complete guide to lhdn income tax reliefs malaysia are you actually paying a lot more if go for 8 personal 2019 ya 2018 money malay mail foreign employees in china individual how calculate monthly pcb.

. Basis Period for Company. RM 63000 RM 1400 RM 9000 RM 4400 RM 48200. PwC 20162017 Malaysian Tax Booklet INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of airsea transport banking or insurance which is assessable on a world income scope.

Tax Rate on Income of Non-Resident Public Entertainers 9 9. Introduced Tax Resident toggle for local and foreigner tax residents to omit EPF contributions. Consequences of Not Remitting Tax 16 14.

Introduced optional RM2000 special tax relief switch to comform to LHDNs standard. Discover Helpful Information And Resources On Taxes From AARP. INCOME TAX EXEMPTION ORDER Rates No Country Technical Dividends Interest Royalties Fees 1 Taiwan NIL 10 10 75 2 Malaysia DTA WHT Rate January 2017.

Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. Introduced optional RM2000 special tax relief switch to comform to LHDNs standard. Of course these exemptions mentioned in the example are not the only one.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8. Malaysia Personal Income Tax Guide 2017 Wealth Mastery Academy. A much lower figure than you initially though it would be.

Useful reference information on Malaysian Income Tax 2017 for year of assessment 2016 for resident individuals. 20001 - 35000. 5 Income Tax No.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT Table provides a view of individual income tax rates and Corporate Income Tax Rates in Malaysia. Ad Compare Your 2022 Tax Bracket vs. Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition.

Income attributable to a Labuan. Taxable Income RM 2016 Tax Rate 0 - 5000. Withholding Tax on Payments to a Non-Resident Public Entertainer 3 8.

Remittance of Tax 15 13. The withholding tax rate on interest royalties and fees for technical services is as provided in the ITA 1967. Changes to individual income tax rate Highlights of 2018 Budget Finance No.

Modal berbayar sehingga RM25 juta pada awal tempoh asas. Added tax comparison with YA2017 limited time only. Ad File For Free With TurboTax Free Edition.

See If You Qualify and File Today. You can check on the tax rate accordingly with your taxable income per annum below. Year Assessment 2017 - 2018.

Your 2021 Tax Bracket To See Whats Been Adjusted. Update Company Information. Public Entertainers other than Filming and Foreign Artistes 14 12.

Change In Accounting Period. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 2 Bill 2017 Proposed amendment to Schedule 1 Part 1 Paragraph 1 to the Income.

B output tax on the sale of goods and services which is borne by a person if he is registered or liable to be registered under the GSTA. Assessment Year 2020 Assessment Year 2019 Assessment Year 2018 Assessment Year 2017 Assessment Year 2016. The following list illustrates the income tax rate for each taxable income group from the year 2010 assessment onwards.

Tax Rate of Company. Total annual income Tax Exemptions Tax Reliefs. Key Malaysian Income Tax Info Do I need to file my income taxYes you would need to file your income tax for this past year if.

Disposal Date And Acquisition Date. Application to Film and Perform in Malaysia 14 11. EPF Rate variation introduced.

Real Property Gains Tax RPGT Rates. Chargeable income RM Current tax rate - 2017 Proposed tax rate 2018 Estimated tax savings RM 5001 - 20000 1 1 - 20001 - 35000 5 3 300 35001 - 50000 10 8 600. Which is why weve included a full list of income tax relief 2017 Malaysia here for your.

Tax Rate of Company. Irs Announces 2017 Tax Rates Standard Deductions Exemption. Where a concession is given the effective date or period of the concession would be mentioned in the respective paragraph where necessary.

Relevant Provisions of the Law 21 This PR takes into account laws which are in force as at the date this PR is published. Update of PCB calculator for YA2018. 22 The provisions of the Income Tax Act 1967 ITA related to this PR are.

Example 8 amended on 12072017. Amending the Income Tax Return Form. Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN.

8 with CCM or Others Date received 1 Date received 2 Date received 3 FOR OFFICE USE LEMBAGA HASIL DALAM NEGERI MALAYSIA UNDER SUBSECTION 831 OF THE INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967. 5001 - 20000. Headquarters of Inland Revenue Board Of Malaysia.

Pendapatan bercukai RM500000 pertama. EPF Rate variation introduced. Income Tax Exemption Income Orders or Income Tax Rules.

Doing Business In The United States Federal Tax Issues Pwc

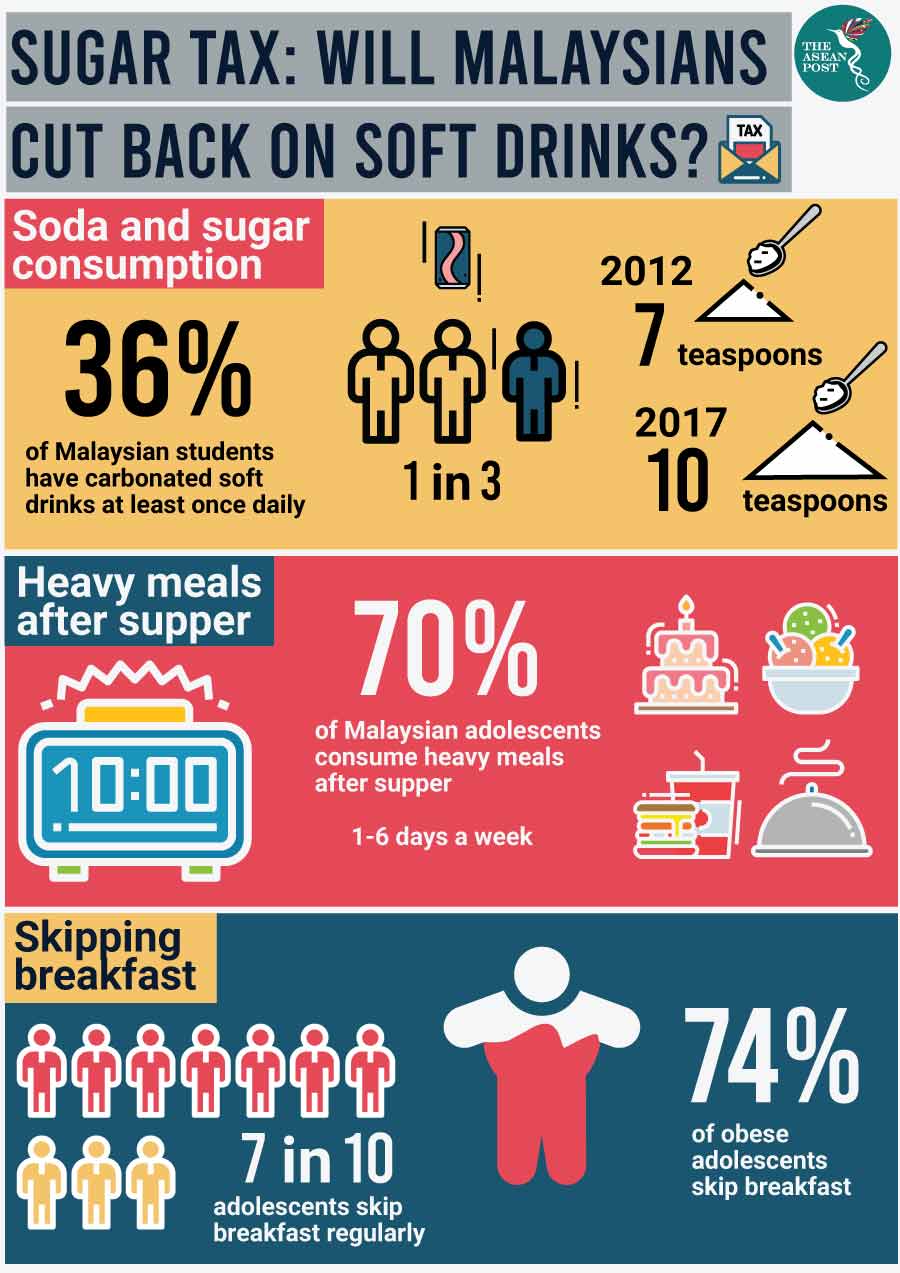

Malaysian Teens Are Overweight The Asean Post

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Malaysia Interest Rate Malaysia Economy Forecast Outlook

Lung Cancer In Malaysia Journal Of Thoracic Oncology

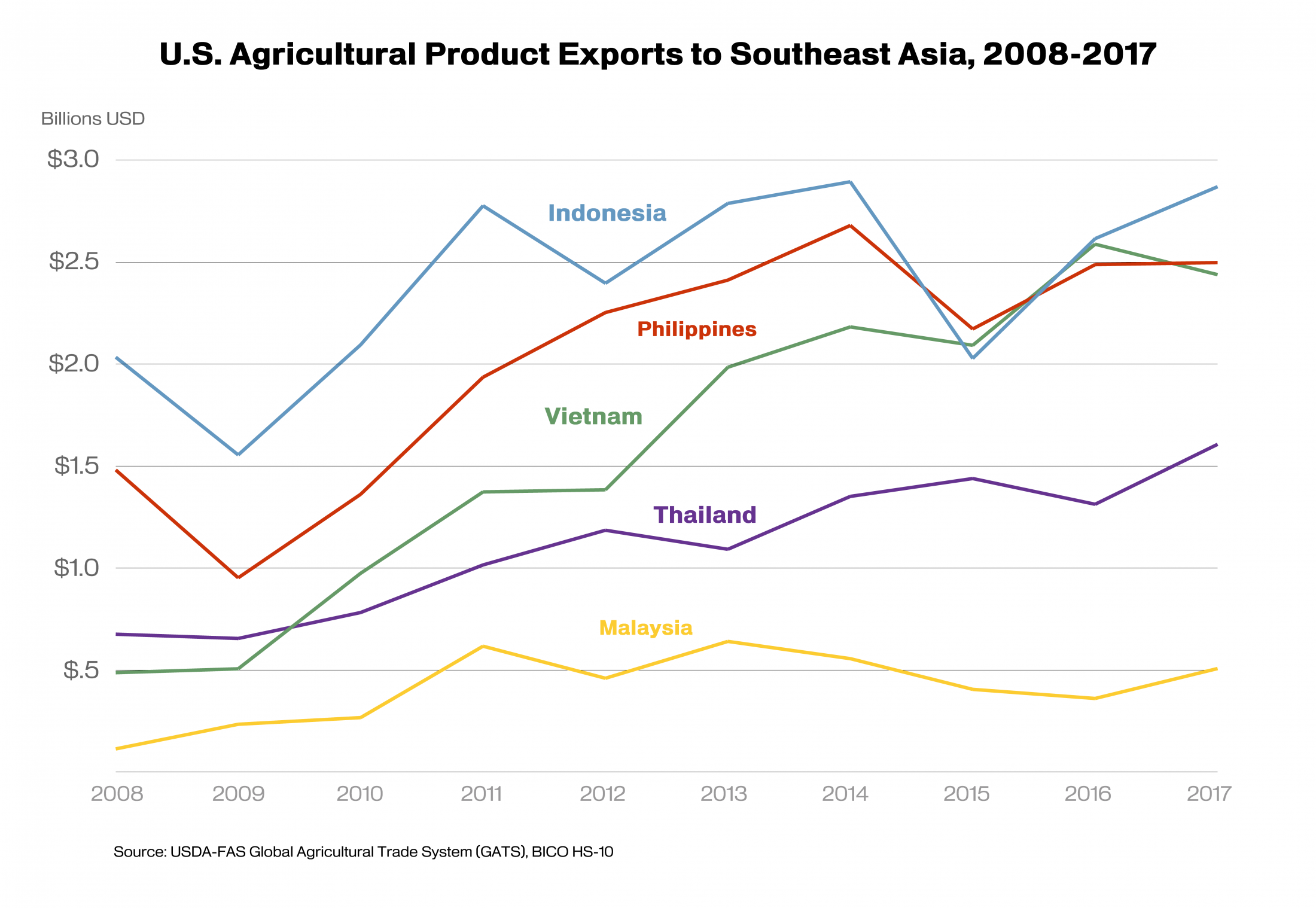

Trade Opportunities In Southeast Asia Indonesia Malaysia And The Philippines Usda Foreign Agricultural Service

Global Student Mobility Trends Focus On Japan Malaysia Taiwan And South Korea

Malaysian Bonus Tax Calculations Mypf My

Malaysia Gross Domestic Product Gdp Growth Rate 2027 Statista

Revenue Of Beauty Personal Care Malaysia 2025 Statista

Malaysia Hospitality Industry Growth Trends Analysis 2022 27

Income Tax Malaysia 2018 Mypf My

Singapore To Impose New Individual Income Tax Rates In 2017 Asean Business News

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

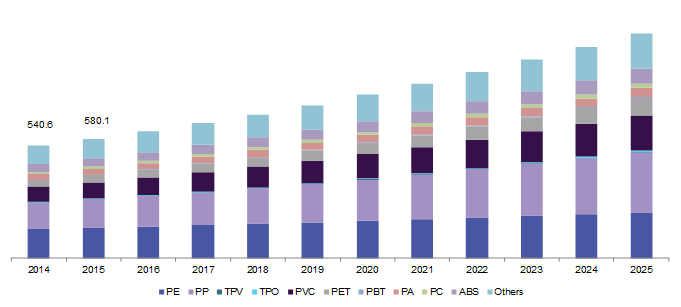

Malaysia Plastic Compounding Market Size Industry Report 2018 2025

Individual Income Tax In Malaysia For Expatriates

Global Student Mobility Trends Focus On Japan Malaysia Taiwan And South Korea

Global Student Mobility Trends Focus On Japan Malaysia Taiwan And South Korea